The Evolution of the Family Office Starts Here

What is a Family Office?

The wealthiest Americans are also the most successful investors, and that is neither a secret nor a coincidence. We believe the reason is simple: they are served by Family Offices.

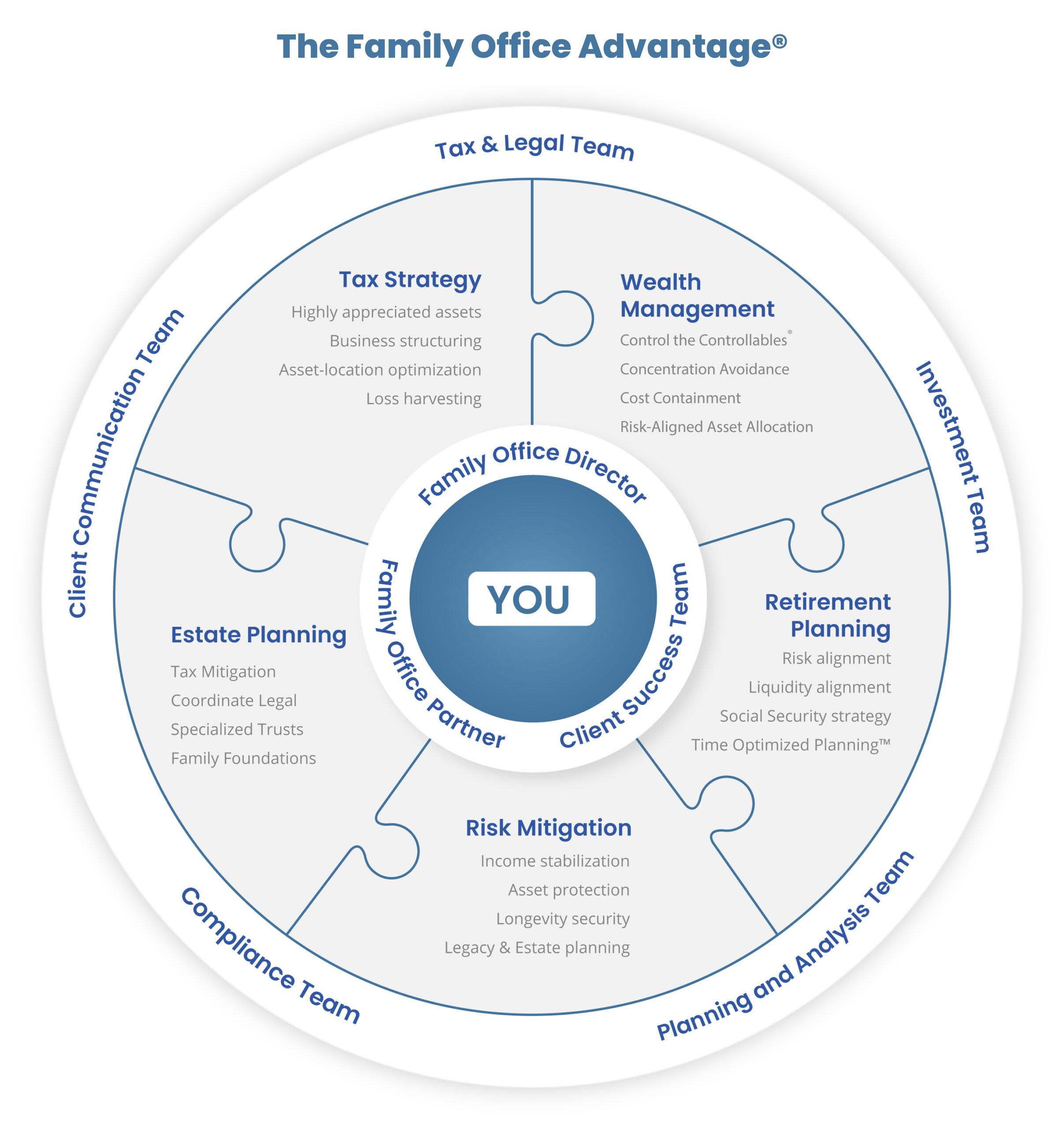

The Family Office focuses on the integration of tax, wealth, and risk management into one cohesive experience. Typically, in financial services, advice is segregated to very specific expertise versus connected across the different financial services disciplines.

Creating a cohesive and integrated plan can have the same impact once only reserved for the wealthiest. It is now available to every American family.

Why You Need a Family Office

We see that too many of our clients suffer from the conflicts, high costs, and inefficiencies that result from working with multiple, often competing financial firms. We have made it is possible for every American family to enjoy the advantages that were once only available to the ultra-wealthy.

Those advantages include lower costs, smarter tax treatment, and a holistic approach to preserving, protecting, and growing their wealth.

Our vision for a brighter future is to provide the professionals, the expertise, the systems, and operational controls required

to deliver the family office experience.

Latest Family Office Articles

Memes Fade, But Meaning Compounds

Markets move on emotion and memes, but lasting wealth needs an anchor. Learn how Financial Gravity helps investors stay grounded in purpose, outcomes, and legacy.

2025: A Mythic and Confusing Year

Cut through 2025’s market myths. See how a Financial Gravity Family Office Director builds coordinated, fiduciary structures that protect you from noisy performance.

Longevity Escape Velocity

Longevity escape velocity is coming. See how a Financial Gravity Family Office Director can redesign your wealth plan so longer lives mean lasting security.

The Curious Case of Brian Johnson

See how data-driven longevity and Brian Johnson’s Blueprint highlight the need for Financial Gravity to design wealth plans built for longer, healthier lives.

How Family Office Thinking Turns Process Into Performance

Learn how disciplined, family office style planning with a Financial Gravity Family Office Director turns taxes, timing and behavior into a lasting advantage.

The Myth of Performance

See why chasing market-beating returns fails and how a Financial Gravity Family Office Director helps you keep more, reduce taxes, and invest with confidence.

What can you expect?

Proactive Tax Planning

Most financial professionals neglect this important discipline, but we believe that it’s not what you make, but what you keep that matters.

Taxes are a drag on portfolio performance, wealth accumulation and lifestyle choices.

We will work to lower taxes in a way that is legal, moral and ethical.

Control the Controllable®

Historically the financial services industry wastes time and money on attempting to control things that can’t be predicted or controlled, such as market direction, volatility, inflation, interest rates, etc.

Our approach is to focus on costs, tax efficiency, diversification and maximum loss exposure. All these things can, and we believe, must be controlled

Multi-Generational Focus

Long-term planning is common among family offices, with a goal of maximizing the wealth transfer to succeeding generations or, in many cases, making an impact on society through charitable giving.

Risk Management

Today risks are magnified for the simple reason that you have so much to protect. Your wealth can make you a target, and the complexity of your holdings can create unwanted personal liabilities that can be managed with careful planning.

Prudence & Discipline

As a general rule, family offices do not take uncompensated risks in their investments. They tend to avoid speculation, preferring instead to take an institutional approach to asset allocation and portfolio management. Family offices accept the ups and downs of markets in ex- change for long term wealth building.

Best Interests Standard

Also known as the fiduciary rule. We follow this standard and put the interests and welfare of our clients first. Because we are Best Interest focused, we search for and implement only what we believe are the most beneficial solutions for the unique needs of the families we serve.